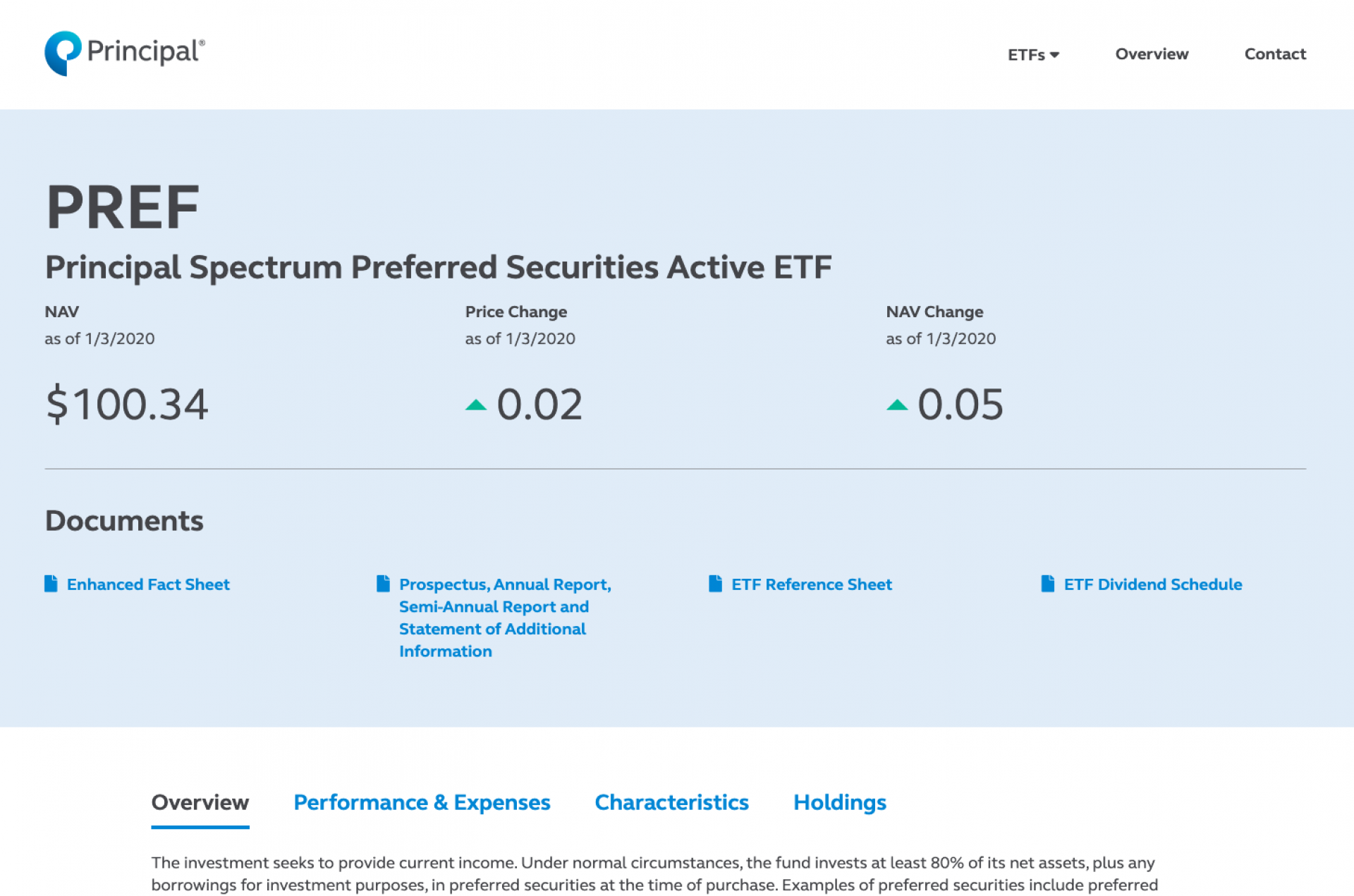

Principal Investments needed a Drupal platform capable of updating its fund data every day through an automated API pipeline. This portfolio showcases the custom features I built for principaletfs.com—ranging from daily data ingestion to dynamic fund displays and investor-focused analytical views. Each slide highlights one of the interactive tools or data-driven components designed to help users explore ETFs, compare performance metrics, and quickly access detailed fund information.

Click any image to view a deeper explanation of the functionality behind it.

Category

Migrated Sites

Financial